Overview

Common questions from users of MyExpense concerning the reporting process, user roles, and the system interface.

MyExpense Interface

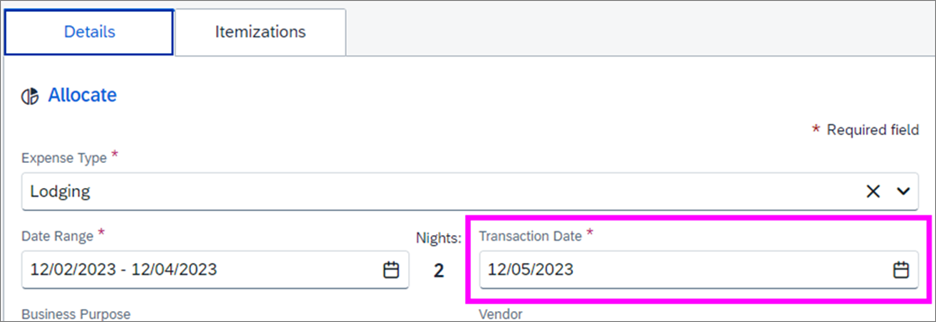

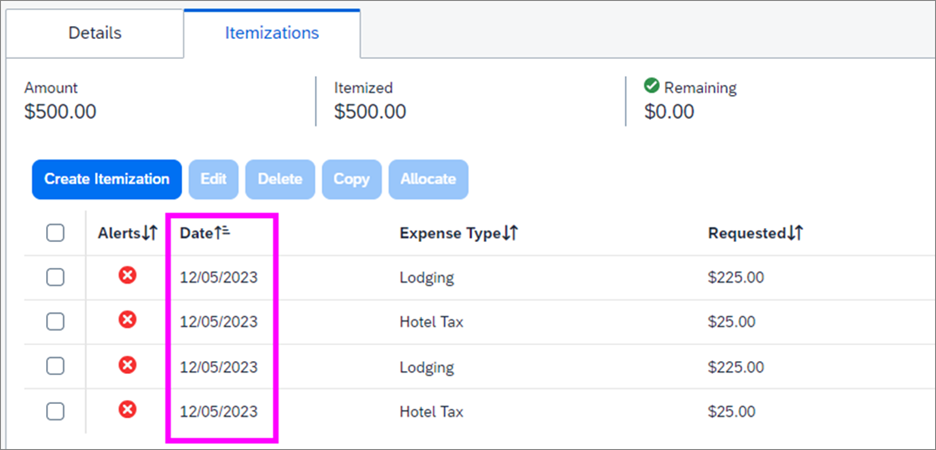

Q: When I update the transaction date for a lodging expense on the details tab, it changes the dates I inputted for my lodging itemizations. Why is this happening?

A: When you make a change to a lodging expense’s transaction date after having created your lodging itemizations, a popup window will display asking if you want the change to be applied to your itemizations and allocations. Clicking on the Do Not Update button will keep the dates of your itemizations and allocations from changing.

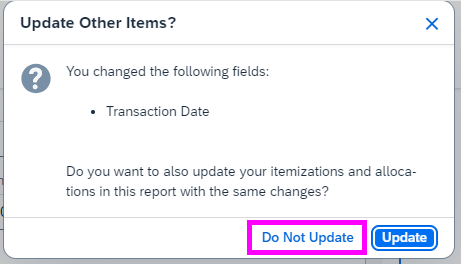

Q: Why is the authorized approver for my department not coming up as an option in MyExpense?

A: A name entered in the authorized approver field returning no results means that the individual is not assigned as an authorized approver for the Dept ID/Cost Center associated with the expense report. To add a new authorized approver, the department head should complete, sign and submit the Delegation of Approval Authority Form.

Q: In MyExpense, I’m a delegate for another user. How do I submit an expense report on their behalf?

A: Instructions for acting as another user:

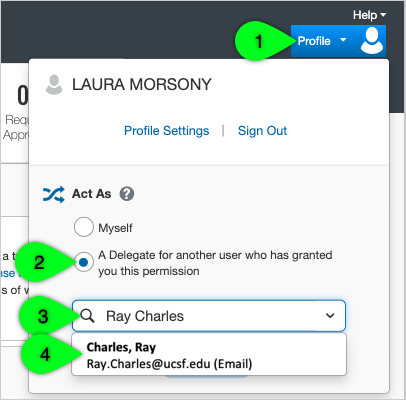

- In MyExpense, click on Profile in the upper right corner.

- Select the radio button to Act As “A Delegate for another user who has granted you this permission.”

- Start typing the name of the person for whom you will be submitting the expense report.

- Select their name.

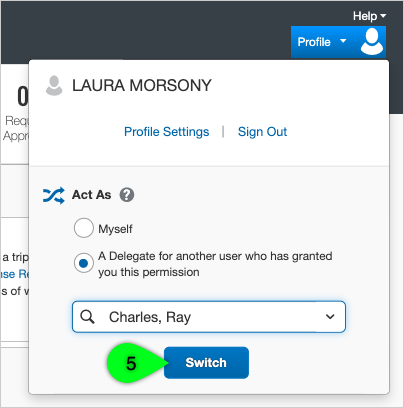

- Select the Switch button.

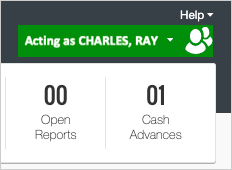

- Their name will now appear in the upper right corner of your screen indicating you are acting for that person.

- While acting as the other user, create and submit the expense report.

- Finally, remember to switch back to your own profile. Click on the other person’s name at the top of your screen. Then, select the radio button next to Myself, and click the Switch button.

Q: MyExpense is prompting an alert that my expense report is over the meal allowance, but my expense report is within the allowable amount. Why is this happening?

A: MyExpense looks across all of an individual's expense reports to check for policy compliance. In this situation, the alert is likely displaying because the expense report owner has another expense report with meal expenses on that same day that is causing a daily meal allowance overage. You can search through your expense reports to find other meals on the same day that are causing the alert to display.

Q: How do I email receipts to show up in MyExpense?

A: To email receipts to SAP Concur and have them show up in the Available Receipts section of MyExpense, you must have a verified email address in your MyExpense profile.

To email your receipts to SAP Concur/MyExpense:

- Using your verified email address, draft an email to [email protected]

- Attach the receipt images.

- Send the email.

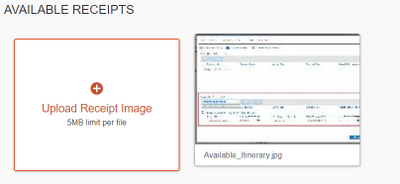

- Your receipts will show up in the Available Receipts section under the Expense tab in MyExpense.

Acceptable file types:

- The available file formats are: PNG, JPG, JPEG, PDF, TIF, OR TIFF.

- For best results, scan or take a photo as a black and white picture with no more than 1024 x 768 image resolution.

To be able to email receipts for use in MyExpense, you will first need to have your email address verified in your MyExpense profile.

Q: Why do I need a business purpose on my expense report? And, what should it say?

A: The Internal Revenue Service (IRS) requires sufficient records to document that the expenses for which the university is paying are related to a legitimate activity from which the university will benefit. A good statement of business purpose for the expense report will answer who, what, when, where and why. Just writing ‘research’, ‘attend conference’ or ‘donor meeting’ is usually insufficient. Travelers may also be asked to provide a business justification for particular expenses.

Receipts and Documentation

Q: Are receipts for any amount always required?

A: No, for most expenses, receipts are required to be attached to your MyExpense expense report only if they are $75 or more. There are some exceptions where receipts are always required regardless of the dollar amount. Common expense types that always require receipts are airfare, lodging, and car rental. For more information, review the Business Travel Made Easy tip sheet.

Q: When do I need a receipt for my expense report?

A: Receipts are required for registration fees, airfare, lodging, and car rental expenses regardless of the amount. Receipts are also required for any expense of $75 or more. A valid receipt will show specifics about the purchase – what was purchased, when, where, the amount, and proof of payment. It will also show all sales tax and fees incurred.