Overview

Guidelines for (campus) employee relocation, process overview and links to policy and resources.

Note: Supply Chain Management processes employee moving and relocation expenses for UCSF Campus employees only. UCSF Health employees should contact their Health HR Representative or UCSF Health Accounts Payable for assistance.

Guidance on employee moving and relocation

Employee moving and relocation expenses are defined as the reasonable costs incurred by a new employee, or by a current employee who transfers to a new University location, for moving household goods and personal effects, and the cost of travel to the University location for the individual and his or her household members. These costs can be reimbursed, in part or in full, when supported by invoices and receipts.

Eligibility

Employees with academic appointments, Management and Senior Professional/Professional and Support Staff (MSP/PSS) and Senior Management Group (SMG) employees may be reimbursed for all or a portion of eligible moving and relocation expenses, or the University may pay vendors directly for applicable costs.

Moving expenses may be paid when a current UC employee is required to transfer or accepts a position at a campus outside a reasonable commuting distance.

All moves of the employee and members of his or her household should be completed within one year of the date an appointee first reports to the new job, even if his or her appointment date was effective prior to the report date.

An employee who voluntarily separates prior to completing one year of service and does not accept a position within the UC system within 12 months of the initial appointment may be required to pay back 100 percent of moving and relocation expenses.

Note: Reimbursements for all moving and relocation expenses made to employees or paid directly to third parties by UCSF are taxable.

Applicable policies

| All | |

| Academic | Academic Personnel Manual (APM) 550, 560, 561 |

| MSP/PSS | Policies and Regulations Governing Moving and Relocation, G-13 |

| SMG | Regents Policy 7710 - Senior Management Group Moving Reimbursement |

Relocation expense definitions

Employee: Prospective employee or appointee

Members of Household: IRS Section 1.217-2(b)(10) defines “members of household” as other individuals who are members of the taxpayer’s household, and who have the taxpayer’s former residence and the taxpayer’s new residence as their principal place of abode. A member of the taxpayer’s household is any individual, including domestic partner, residing at the taxpayer’s residence who is neither a tenant nor an employee of the taxpayer.

Household Goods and Personal Effects: Household goods and personal effects include furniture, clothing, household appliances, and other items that are usual and necessary for the maintenance of a household.

Freight Costs: Freight costs include the total charges for transporting household effects from the point of origin to the point of destination. Freight costs also include associated charges such as packing containers, labor, and insurance of household and personal effects.

Moving and Transferring Expenses: Moving and transferring expenses are defined as the reasonable costs of moving household goods and personal effects to a new residence. These include the cost of travel to the university location for the prospective employee and his or her immediate family.

Reasonable Costs: Reasonable costs are costs that are considered to be reasonable under the circumstances of a particular move such as travel from the old to the new residence made via a conventional mode of transportation using the shortest and most direct route available and in the shortest period of time normally required to travel the distance.

Commuting Distance: The distance between the individual's new job location and his or her former principal residence must be at least 50 miles more than the distance between the individual's previous work location and his or her formal principal residence.

Contracting with suppliers

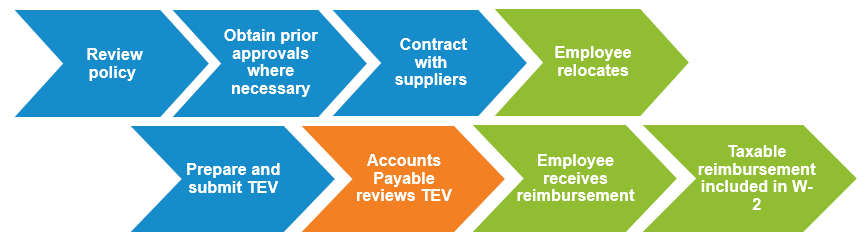

Departments may contract directly with suppliers to provide moving and relocation services. In these cases, the University pays the cost of transporting the household goods and personal effects of a new appointee or employee directly to a common carrier or household mover. When contracting with a moving company as part of a household move for a new campus hire, submit your request in BearBuy using the UCSF Relocation/Household Moves Form to create a purchase order (PO) for the supplier. The supplier will invoice the University using the purchase order.

Preferred suppliers (moving companies) have contracts with UC Office of the President (UCOP). To search these contracts, log in to CalUSource using your UCSF MyAccess credentials. Review the training materials on the CalUSource website to learn how to search for contracts. Try searching for contracts using keywords, such as "move," "moving," or "relocation."

After the move, the employee will submit a Travel Expense Voucher (TEV) to claim reimbursement for moving and related travel expenses. The employee must include the name of any third-party vendor paid directly by the University and indicate this was a third-party payment on the TEV form. In addition, they must attach supporting documentation, such as a copy of the invoice.

Approval considerations

Department heads are authorized to approve relocation expenses. This authority can be delegated, but the delegated individual must have a current Signature Authorization (U242) form on file with Supply Chain Management. The Approver is responsible to ensure expenses were not previously reimbursed, all expenses are allowable per policy, and all required supporting documentation is attached.

Prior approval for expenses exceeding policy thresholds

Exceptions to policy are highly discouraged. Relocation expenses should consist of only allowable types of expenses and not exceed maximum thresholds. In the rare case of exceptions with a strong business case, prior approval is required for expenses that will exceed the policy threshold (refer to Reimbursable vs. Non-Reimbursable Expenses below for common reimbursement limits). Obtain exceptional approval prior to incurring expenses and provide evidence of exceptional approval with the Travel Expense Voucher (TEV).

Note: Only specifically designated individuals with the delegated authority may consider and grant exceptions.

Guidance on allowable expenses

The lists below serves as a general guideline for understanding reimbursable or non-reimbursable relocation expense and may not capture all expense types and conditions. Therefore, it is not intended as a replacement for policy. For more detailed information on policy guidelines and requirements refer to UC Policy G-13, Policy and Regulations Governing Moving and Relocation.

Reimbursable Expenses

Airfare: Employee, first trip associated with start of work (one-way coach airfare) is considered a final trip. Family members, airfares for final trip (one-way coach airfare).

Utilities: Connecting and disconnecting utilities, but not refundable deposits.

Domestic Pets/Household Pets: Transportation of domestic pets (does not include livestock) normally kept or permitted in residence, from the old to the new residence. Expenses associated with kenneling of such pets are not reimbursable.

Gasoline for rental vehicle.

Household Goods: Packing, crating, unpacking, uncrating, and transporting of household goods & personal effects from former primary residence to the new primary residence. Limited to one household move per appointee.

Insurance: Cost of insurance for household goods while in process of being transported to new residence, if incurred within any 30-day period after removal of the household goods and effects from the former primary residence.

Lodging: Between old residence and new residence. Lodging expenses incurred while in the general location of the old residence "within one day" after it is no longer suitable for occupancy, and while en route from the old residence to the new residence including the day of arrival at the new residence. Lodging maximum allowable: See Per diem rates

Meal expenses: between old residence and new residence. Meal expenses incurred in traveling/moving from old residence to the new residence. Actual meal and incidental costs are not to exceed the Per diem rates.

Relocation of Motor Vehicles: Up to two personal motor vehicles (motorcycles included) per household; but not motorized recreational vehicles, boats, kayaks, canoes, airplanes, camping vehicles, snow machines, jet skis, etc.

Movers: Hired and paid by employee.

Movers: Hired by employee, paid by University directly. Expenses directly paid to movers by the University are taxable to the employee and applicable payroll taxes will be deducted from the employee’s paycheck.

Moving Van Rental: Reimbursement based on mileage is not allowed.

Parking & Tolls.

Personal Car Mileage: Mileage rate for moving and relocation differs from "University Business Travel." Mileage rate includes the cost of gas and wear and tear on the personal vehicle. See Per diem rates

Rental Vehicle: In addition to the rental fees, actual expenses, such as gas, parking fees, and tolls are considered taxable. There is no mileage rate reimbursement for rental vehicles.

Storage - First 30 days: Temporary storage of household goods and personal effects while in process of being transported from old residence to the new residence. Maximum storage costs of 30 days if employee is unable to move directly into the new residence.

Temporary Living at New Job Location (after day of arrival): Up to 30 days furnished temporary lodging, including residential parking fees.

Meals: Up to 30 days of residence in temporary lodging. If temporary lodging has cooking facilities, then only groceries (not meals) will be reimbursed. If temporary lodging does not have any cooking facilities, then only meals (not groceries) will be reimbursed in accordance with UC Policy G-28, Travel Regulations external site (opens in a new window) daily meal limit.

Parking Fee/Permit for Container Drop-off.

Sale of Former Primary Residence Costs: The sale of the residence must occur within 12 months of the appointee's start date. The amount of reimbursement will depend on prevailing practices within the area of the sale. Actual and reasonable selling costs include:

- Brokerage commission, not to exceed 3 percent of the final sales price or $30,000, whichever is less.

- Non-recurring closing costs not to exceed 2 percent of the selling price, not to exceed $20,000, whichever is less.

- Mortgage prepayment penalties not to exceed $15,000.

- Miscellaneous seller's costs customary to the area that may be reimbursed if determined appropriate by the University, not to exceed $10,000.

- Settlement of Unexpired Lease (Former Primary Residence)

Leases: If appointee must settle lease to relocate, actual and reasonable costs include:

- Reimbursement shall not exceed six months of the lease or $25,000, whichever is less, including any penalty paid to terminate the lease.

- Reimbursement is not allowed if the appointee knows or reasonably should have known that relocation was imminent prior to entering a lease agreement.

- Reimbursement is not allowed for the cost of physical improvements intended to enhance marketability of the leasehold by improving the condition or appearance of the residence.

Third-Party Expenses: Expenses directly paid to third-parties by the University are taxable to the employee and applicable payroll taxes will be deducted from the employee’s paycheck.

Non-reimbursable expenses

Pre-Move & House Hunting Expenses: Generally, return trips are not reimbursable.

House Hunting-Travel expenses, meals & lodging, & rental car for pre-move: Generally, house hunting trips are not reimbursable.

Moving Expenses - Personal Travel (Final Trip): Generally, relocation allowance is not allowed.

Loss on the sale of a home.

Any part of the purchase price of a new home.

Costs Associated with Purchase of New Primary Residence.

Property-Related Taxes: Income Taxes/Real Estate Taxes/Property Taxes, and assessments associated with purchase or sale of primary residence.

Pre-Sale Remodeling: Cost of physical improvements intended to enhance salability by improving the condition or appearance of the residence.

Storage > 30 days: Generally, storage costs > 30 days are not reimbursable.

Examples of other non-reimbursable expenses include (but not limited to):

- Assembly and disassembly of unusual items such as swing sets, swimming pools, satellite dishes, etc.

- Canned, frozen, or bulk foodstuffs

- Building suppliers, farm equipment, and firewood

- Plants

Refer to G-13, Policy and Regulations Governing Moving and Relocation for more details on non-reimbursable expenses.

Claiming expenses for reimbursement

Do not submit relocation expense reimbursements through MyExpense—these expenses cannot be paid through MyExpense.

Moving and relocation expense reimbursement requests are submitted using a Travel Expense Voucher (TEV). The TEV must be completed and submitted within 45 calendar days after the expenses were paid or incurred. Additional taxes may be applicable if submitted more than 60 days after the reimbursable expenses were paid or incurred. Reimbursements for all moving and relocation expenses made to employees or paid directly to third parties by UCSF are taxable. All official travel must be properly authorized, reported and reimbursed in accordance with UC Policy.

Receipt requirements

Receipts are required for the following types of expenses:

- All airline expenses – airline itinerary showing last four digits of credit card payment and class of fare.

- All lodging expenses – itemized hotel folio with method of payment and zero balance.

- All rental car expenses – itemized receipt showing car size, method of payment and zero balance.

- Gifts provided to a host for lodging costing $25 or more.

- Meal and local travel expenses of $75 or more.

- All moving (non-travel) expenses, e.g., packing and moving household goods and personal effects, etc.

- All third-party payments made directly by the University.

- All other expenses of $75 or more.

Submitting expense reimbursement requests

Download the Travel Expense Voucher (TEV) form, and follow all instructions to properly complete the form. To learn more about the TEV, view Travel Expense Voucher.

List each expense in detail and provide supporting documentation/receipt when required per policy (see Receipt Requirements above). Expenses will not be reimbursed without proper documentation/receipts.

Include the name of any third-party vendors paid directly by the University and indicate this was a third-party payment. Attach supporting documentation, such as a copy of the invoice.

Provide additional information to explain any unclear requests for reimbursement. Any expenses incurred under a name other than the employee must have an explanation of the relationship to the employee.

Add the position of the new hire, (e.g., Academic or SMG) to the Purpose of Trip box on the TEV form. Attach a copy of the employee’s offer letter for the position.

Before submitting the TEV, obtain the signature of your Department Head/Delegated Approver within your department; refer to Approvals external site (opens in a new window) (above) for details.

Finally, email the completed TEV to [email protected] with “Relocation” as the first word in the subject line.

Do not submit relocation expense reimbursements through MyExpense—these expenses cannot be paid through MyExpense.

SCM Accounts Payable Review and Payment

SCM Accounts Payable (AP) will review the completed TEV and determine which relocation reimbursements are allowable. Accounts Payable reports all allowable relocation expenses (considered imputed income) to UCSF Controller’s Office Payroll. Payroll will include the reimbursement and deduct applicable payroll taxes (e.g., income tax and other statutory deductions) on the employee's paycheck and include the taxable reimbursement in the annual reporting of imputed income and taxes on the employee's annual W-2. Relocation expenses are only paid by Payroll following the employee’s regular pay periods. Due to this limited pay schedule, please allow 2-3 months for review and payment.