Overview

Travel expense reports are compiled, submitted, and approved via MyExpense for reimbursement. MyExpense (a Concur portal) is available through MyAccess.

Considerations

Expense reports need to be submitted promptly with complete and detailed documentation.

The traveler or traveler's delegate should submit the expense report within 45 days after the completion of the trip. When a trip lasts more than 90 days, a quarterly report is required.

Employee expense reports submitted more than 60 days after the completion of the trip (or end of the quarter) will be reported as taxable income, read more about late expense reports.

Expense reports must include supporting documentation substantiating the business purpose for each day of travel, as well as receipts for certain expenses.

Travel policy requires compliance with current maximum daily expense caps and allowable/unallowable expenses for UCSF travelers. All current rates and allowables are listed in our maximum allowable rates table.

Acting as a Delegated Expense Reporter

The employee seeking reimbursement may wish to delegate the MyExpense reporting to someone else. This is allowed with appropriate authorization. When submitting an expense report as a delegate for another employee, remember to turn on the acting as a delegate feature in MyExpense before starting the expense report; see instructions below. When finished, remember to stop acting as a delegate.

Acting as a Delegate in MyExpense

- First, the employee must grant you delegate access in their profile; refer to Grant Delegate Access for instructions.

- Then, you can act as a delegate:

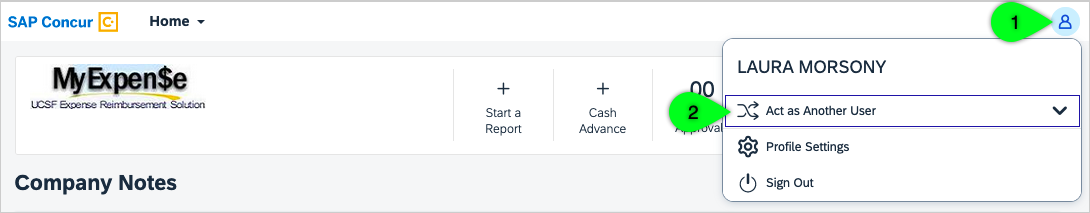

- In MyExpense, click on the User Profile icon in the top right corner of your screen, and then select Act as Another User.

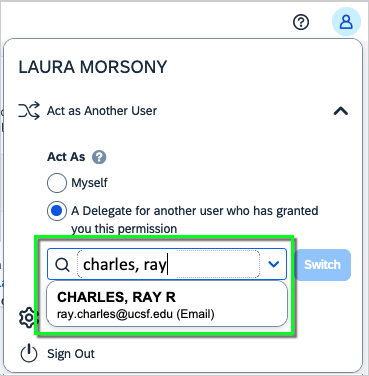

- Start typing the person's name in the search box, and select their name.

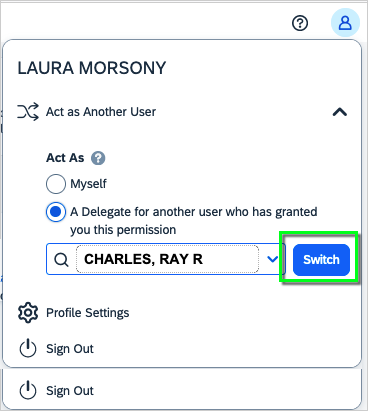

- Click the Switch button on the right.

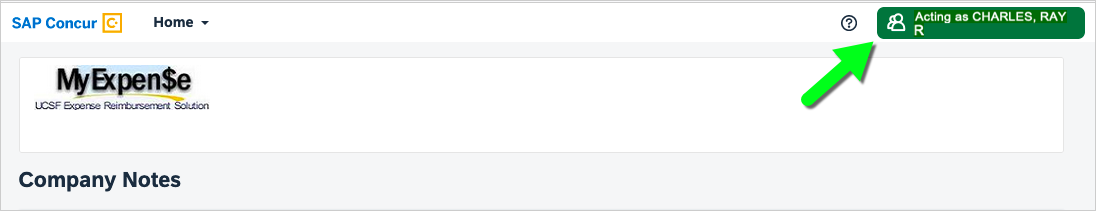

- You will now see a message at the top warning you that you are acting as another user.

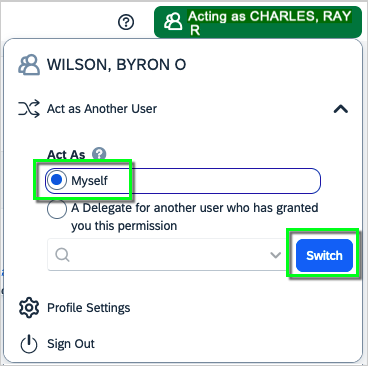

- When you're done, click the "Acting as" button (at the top). Then, select Myself and click the Switch button.

Supporting Documentation Requirements

Travel Business Purpose

The IRS requires sufficient records to document that the expenses for which the University is paying are related to a legitimate activity from which the University will benefit. On your expense report, a good business purpose for the trip will answer who, what, where, when, and why. Just saying "research," "attended conference," or "donor meeting" is usually not sufficient. Each expense report must have documentation attached that fully describes the business purpose of each day of travel, including:

- Meetings - documentation must specify meeting dates, times, locations, general meeting topics, attendees, and organizational affiliations

- Conferences - conference brochure, agenda or event announcement for conferences and professional events

- Confidential meetings (ex: research subject travel) - provide as much information as possible to justify the business purpose

- Complex travel itineraries such as a research project that involved extended travel with multiple destinations - include documentation such as a brief narrative, explaining why the traveler needed to go to each location.

Reimburseable vs. Non-Reimburseable Travel Expenses

The current maximum daily expense caps and allowable/unallowable expenses for UCSF travelers are listed in our maximum allowable rates table. Refer to UC Policy G-28, Travel Regulations for full details, including reimbursement daily maximum allowable expenses.

Receipt Requirements for Travel Expenses

The traveler is required to attach receipts for certain types of expenses, per UC Policy G-28. A valid receipt will show the specifics of the purchase—what was purchased, when, where, the amount, and proof of payment. It will also show all sales tax and fees incurred. Generally, the person making the purchase possesses the receipt, which substantiates who should be reimbursed; however, receipts for airfare, hotel, and rental cars require additional detail (see below).

The following receipts must be attached to your expense report:

- All airline expenses – airline itinerary showing last four digits of credit card payment and class of fare

- All actual lodging expenses – hotel folio with method of payment and zero balance

- All rental car expenses – itemized receipt showing car size, method of payment and zero balance

- All registration fees

- Receipts for gifts provided to a host costing $25 or more

- All other expenses of $75 or more

Note: A credit card statement is NOT an acceptable receipt. Airlines, hotels, and rental car agencies can typically provide a duplicate receipt, if you lost or misplaced the receipt. If you cannot obtain a duplicate receipt or an itemized original receipt is not available, please attach the Declaration of Missing Receipt Form to your expense report.

Training Resources

UCSF travel training resources: