Overview

Information on when and how to complete a capital equipment form in BearBuy.

Capital Equipment Defined

The BearBuy Capital Equipment Form should be used when purchasing equipment with a value of $5,000 or more. There are a few things to consider to ensure you are processing your order in compliance and that the information received by our downstream systems for the purchase are accurate and as complete as possible for capitalization in UCSF’s Asset Management System.

Background and Other Information

- Equipment purchase for use in another country requires that the departments seek ‘Export Control’ pre-approval from Office of Ethics and Compliance, and pre-approval from Capital Accounting. No equipment may leave without approvals.

- For equipment purchased for use by another entity, or on loan, department custodians must seek pre-approval from Capital Accounting prior to issuing the requisition.

- Software included with the purchase cost of hardware (not separately identified on the vendor's invoice) shall be capitalized and included as part of the value of inventorial equipment.

- When it is time to dispose of inventorial equipment, the Department Asset Custodian will work with Capital Accounting, and the Office of Sponsored Research if applicable, to ensure the equipment can be removed from inventory. See Logistics Capital Asset Surplus Property Disposal.

- Special procedures are required to trade-in property to which the University holds conditional title. (Conditional title reserves to the transferor the right to revoke transfer of title, to receive the proceeds of any subsequent sale, or to acquire an interest in replacement.) Generally, departments should obtain unrestricted title to property before it is declared excess for disposal.

For additional guidance see Price Reasonableness and Source Selection.

Considerations when purchasing Capital Equipment

Consider using any established agreements that could help determine your supplier selection, possibly improve product pricing, and offer better terms and conditions of sale. Refer to the UCOP System wide Agreement listing to see if an agreement applies to your purchase. If you are using such an agreement please enter as much contract information (title, reference, number, etc.) as you can in the Equipment Description field.

- Department makes a determination that the purchase is capital equipment.

- Verify that the equipment has a normal life expectancy of more than one year, and is not expendable. Non-expendable means that the equipment is not consumed by its use.

- Verify that the capitalized cost will exceed $5,000. The $5,000 value includes the price of the equipment and other costs needed to put the equipment into service such as required installation services, startup components, accessories, freight, handling and sales tax.

- Department determines if trade-in will be involved.

- If a trade-in is part of the purchase, the Department Asset Custodian must seek pre-approval from Capital Accounting before the release of the existing equipment for trade-in before the requisition is submitted.

- Establish the price for trade-in and arrangements for the supplier to receive or pick up the product.

- Determine if the equipment qualifies for the California Partial Sales Tax Exemption, see: Partial Sales-Tax for R&D

Completing the Capital Equipment Form

The Capital Equipment form is divided into sections that contains optional as well as required fields noted in bold on the electronic form. For clarity in this training document required fields are noted as (Required) before the field definition. Required fields must be completed before the form can be submitted.

Important Note: It is important to complete the new form to prevent delay on your order. Do not copy and add to cart an old form you have previously submitted.

1. Supplier Information

- (Required) Enter the Supplier or select Supplier Search to locate the supplier associated with the Equipment purchase

2. Equipment Information

This section provides information related to the details of the equipment purchase. Information entered for the Equipment Description, Equipment Category, Used for Research, Manufacturer Name, Manufacturer Part Number or Model Name, In a Core as well as the Quote Number are searchable within the Asset Management system and the Capital Equipment Web Search page.

- (Required) The Equipment Description should include the type of equipment and/or a list of major components that make up the equipment configuration.

- (Required) Select the Equipment Category for the purchase. Currently the Equipment Categories available apply broadly to Research Equipment. If you do not find an equipment category that applies to your purchase but is research related, select equipment category Other-Research. If your purchase does not apply to research equipment, select Other-Non-Research.

(Required) Use for Research, select Yes or No. Refer to the following grid for guidance. All answers to the posed questions must equal Yes, in order to select an option of Yes.

Research and Development Equipment Evaluation QUESTION SCENARIO 1 1. Does the equipment support R&D activities related to one of the following:

a. Biological Science (NAICS code 541711)

b. Physical Science (NAICS code 541712)Yes 2. Is over 50 percent of the equipment time used for qualified R&D activities? Yes 3. Is the equipment useful life greater than one year? Yes 4. Is the cost of the equipment greater or equal to $5,000? Yes Research Flag Yes - (Required) Provide the Manufacturer Name and Manufacturer Part Number (this is the model number and may be the same as the supplier’s part number).

- Provide the Supplier Part Number (this is the supplier’s identification number for the equipment model).

- Provide the Quote Number

- (Required) In the Price field enter the price of the equipment.

- Include the value of any software that is essential to running the equipment (it is part of the capitalized price). Do not include any software that is listed on the quotation as an additional item. Do not include software that is not critical to the operation of the equipment.

- Reduce the price by the amount of trade-in amount. For example, if the equipment is $5,500 and the trade-in amount is $500, enter the Price as $5,000) Note: this form is not designed to calculate sales tax on trade-in value.

- (Required) Enter the Quantity.

- If there is a trade-in, enter the value in the Trade In Amount field.

- If there is a trade-in, specify the Tag Number of the equipment to be traded in in the Additional Internal Comment field. The Tag Number is noted on a Capital Accounting Tag placed on the equipment.

- Add additional, separate PO lines that match the quote, and review and flag PO lines as Capital Expense or Taxable. Ensure that the correct commodity code is used for Capital and Non-Capital lines. *Failure to do so may cause missing assets and/or require departments to enter correction journals.

3. Additional Equipment Information

This section allows you to communicate with the Controller’s office by indicating how you would like to manage the equipment once it is capitalized in the Asset Management system. The Controller’s office may follow-up with you on any questions they have regarding your instructions.

- (Required) Part of an existing system? Select Yes or No if the equipment purchase should be added to the value of existing tagged equipment

- If the answer to the above is Yes? Enter the Tag# for the existing system.

- (Required) Track Equipment Components Separately? Select Yes or No if you would like the equipment purchased broken up into multiple tag #s. This action will allow maintenance information to be tracked and maintained per equipment component in the Asset Management system and provides visibility by tag #s of each component during the physical inventory process. Each Component of the order must meet the threshold of $5,000 and above requirement to receive a separate tag #.

- Capitalization Instructions: If the answer to the above is yes. Provide instructions to Capital Accounting as to how many asset tags you want and how to group them.

- Instruction Examples:

Ex.1 “Please capitalize as one single system”

Ex. 2 “Please create separate tags to track lens separately, costing $7,000 each” from Microscopes

Ex. 3 “Assets to be tracked as 3 systems, each comprised of:

(1) Base unit @ $6,000, (3) Accessories @ $2,000), and software separated as (3) systems.”

- Instruction Examples:

- (Required) In a Core? Select Yes or No if the equipment purchased will be part of a Core. “In a Core" is defined as a shared resource laboratory that provides services, products, and/or equipment to the UCSF research community

- (Required) Exclude from Capital Equipment Web Search? Select Yes or No. A selection of “Yes” will prevent the equipment from appearing in UCSF’s Capital Equipment Web Search page open to employees under UCSFs Intranet.

4. Installation and Warranty Details

- Use the Additional Installation Information field to include information such as the expected date(s) of installation, duration, any special requirements needed by vendor, etc.

- The Additional Warranty Information field can be used to identify general warranty provisions such as warranty period, usually expressed in a number of days, e.g., 90 days (calendar days unless otherwise stated) and coverage (e.g., parts, labor and travel).

5. Delivery Information

- Delivery Contact Information identifies the person that the equipment will be delivered to. Typically this is not the same person as the Requester or Requisition Approver of an order.

6. Department Information

- (Required) Complete the Department Information. Specify the department name as well as the contact information for the departmental person who will answer technical questions (e.g. setting up equipment, equipment functionality, etc.) about the equipment.

7. Price Reasonableness and Source Selection

This section is required when making a purchase on goods or services using either federally funded dollars of $50,000 or more, or non-federally funded dollars of $100,000 or more per Federal and/or UC/State policy/guidelines. This information must be documented in BearBuy.

- The Source Selection refers to the process of selecting and contracting with the most qualified proposal that meets UCSF’s requirements. There are four options for Source Selection that can be selected. If you are unsure of the Source Selection type, contact your department-assigned buyer.

- If selecting New or Existing Bid, enter the bid number you will be using.

- If selecting Non-Formal Quotes, attach three competitive informal quotes and provide Price Reasonableness information.

- If selecting Registered Small Business, provide Price Reasonableness information.

- If selecting Sole Source, provide Sole Source Justification and Price Reasonableness information.

8. Attachments

- (Required) External attachments: Add a detailed Statement of Work must be attached before submitting this form. Attach any relevant supporting documents (i.e. vendor quote, technical specifications, warranty information, service level agreements, etc.) If available, also attach the Vendor Quote/Proposal.

- Internal Attachments: If available attach a product image. The image can be reviewed throughout the approval process

9. Additional Instructions

- Complete a separate Capital Equipment Form for each piece of equipment ordered on the requisition.

- To do this, fill out the Capital Equipment Form completely for the first piece of equipment, then from the Available Actions dropdown on the form, select Add to cart and click the Go button. This will add the form to the cart and keep the form open with all the information previously filled out on the form.

- You can reuse the form to add the next piece of equipment by changing the appropriate sections of the form and adding the form to the cart again.

- Indicate whether your equipment is taxable in the cart.

- If the equipment is taxable, check the Taxable checkbox for each line.

- If the equipment is not taxable, do not check the Taxable checkbox for each line.

- Specify the asset management codes for the users who will manage the equipment in the Asset Management System, especially the Custody Code for the Custodian of the equipment and if known the Curator Name of the lab personal or other party

- After clicking the Proceed to Checkout button, navigate to the Asset Management tab.

- Input the Custody Code, Asset Location and Curator Name.

- Input the Tag Number ONLY if the purchase is adding to the value of an existing piece of equipment.

- Add-to-Value vs. Replacement component Add-to-Value refers to a component part with a cost of $5,000 or greater which permanently increases the value or useful life of an existing University owned unit of inventorial equipment and is added to the value of that unit as a capital transaction. The description of upgraded equipment items should be revised to reflect any material enhancements.

- If you have a different set of asset management codes for each piece of equipment, specify them for each line.

- This form will default a commodity code of ‘00330 – Inventorial Equipment ≥$5,000’, this will make the Account default to ‘52603’. If you are purchasing Computers ≥$5,000’, please manually code the PO line to ‘52601’.

- If the equipment purchase uses sponsored project funding sources, please specify the following Accounts for each sponsored project funding source in the Accounting Codes (chartfields) section during checkout:

- 51321 - Sponsored proj equip ≥$5K, non-comp

- 51322 - Sponsored proj computer ≥$5K

- 51323 – Sponsored proj software ≥$5K

- If the equipment purchase uses sponsored project funding sources, please specify the following Accounts for each sponsored project funding source in the Accounting Codes (chartfields) section during checkout:

Otherwise, please select the correct Commodity Code for each PO line

Managing Capitalized Equipment

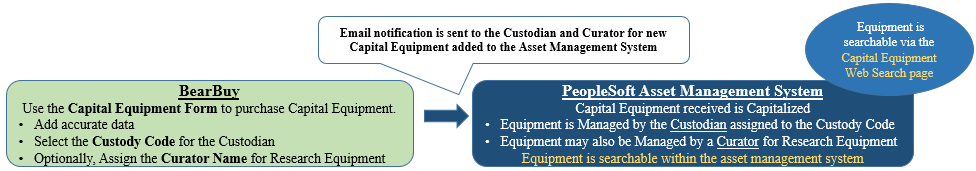

BearBuy Capital Equipment Purchases are sent to UCSF’s Asset Management System

There are two roles in the Asset Management System that are selectable in the BearBuy Asset Management tab. Users assigned to these roles in BearBuy during the purchase process will receive an email notification when the capital equipment purchase information is sent to the Asset Management system. The assigned users can make important non-financial updates to the capitalized equipment that improve data integrity and searching capability. The assignable roles are as follows:

Custody Code: Custody Codes are maintained by the Controller’s office and are preassigned to a specific equipment Custodian within the Asset Management System. All equipment must be assigned a Custody Code. When assigned the Custodian can for example, add the equipment serial number, update the equipment condition, location, or add a photo, etc. (Learn more about Custodian responsibilities.)

Curator Name: The Curator role is typically assigned to lab personnel. Departments should request security setup in the Asset Management system prior to starting the purchase process in BearBuy so that the Curator Name can be selected. The Curator Name is optional. When assigned the Curator can, for example, add descriptive keywords for equipment that makes searching by others more successful, note if equipment is shareable or add a lab name, etc. (Equipment Curator Information)

Searching for Capitalized Equipment on Campus

Approved purchases made for Capital Equipment in BearBuy are ultimately sent to UCSF’s Asset Management System for capitalization. Key information entered in the Capital Equipment Form is available for UCSF personnel to search upon within the Asset Management system and may also be searchable via the Capital Equipment Web Search page by UCSF personnel. (Capital Equipment Web Search)

Capital Equipment Purchasing Resources

UCOP BUS - 29: Management and Control of University Equipment

UCOP BUS-38: Disposition of Excess Property and Transfer of University-Owned Property - outlines general requirements to ensure the proper protection of, accounting for, and disposition of University-owned excess property.

UCOP A-51, Application of Proceeds from the Sale, Trade-in, or Transfer of University Property

UCSF Capital Accounting: Controller’s Office resource covering University-owned assets.