In an effort to implement stronger fraud prevention standards, Supply Chain Management (SCM) relocated all Card Programs information out of the public SCM website and into the UCSF Finance Secure site. Procurement Card (P-Card) and Corporate Travel Card information will be available to all UCSF staff via MyAccess login.

The relocation will not affect the policies or content related to either card program.

To access the information, please carefully read all of the following instructions.

- Click the button below to lead you to the MyAccess login page.

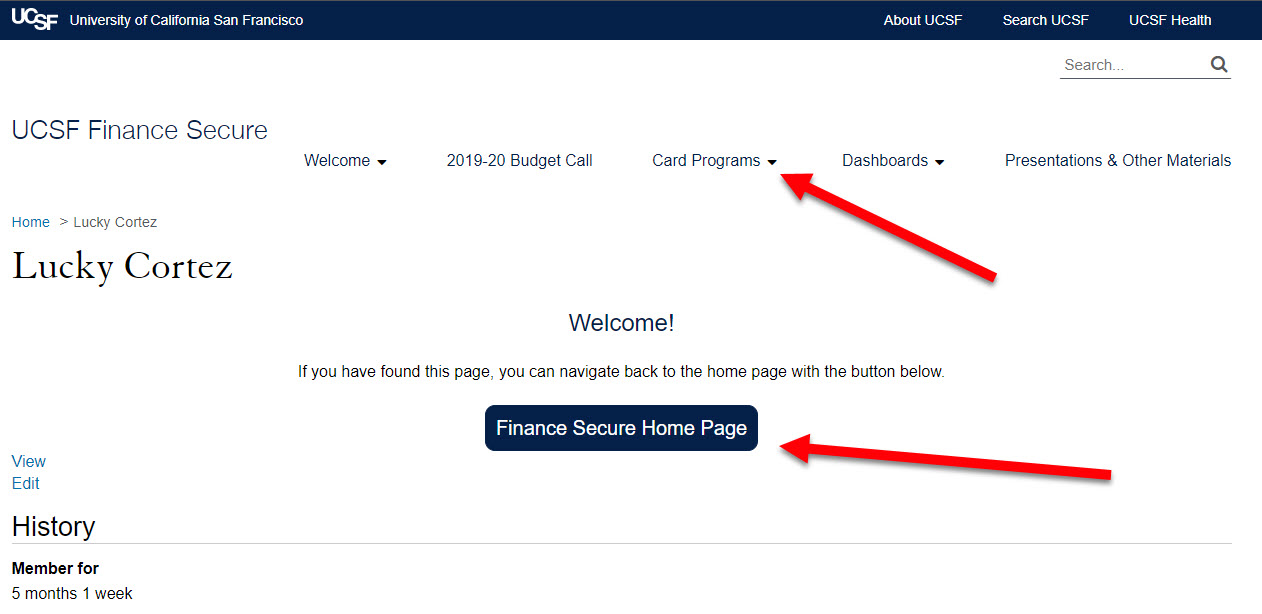

- Log into the system using your MyAccess login credentials. You will be brought to the Finance Secure Welcome page.

- Click the Card Programs button directly within the Supply Chain Management welcome menu. Select the appropriate Card Program.

Note: Finance Secure cannot be reached through the MyAccess portal. You can access the site using the button below.

I logged into MyAccess and still cannot login, how do I access the information?

What is a "User" page, and why did I land on it?

I still cannot access the Card Programs Information, how can I get help?